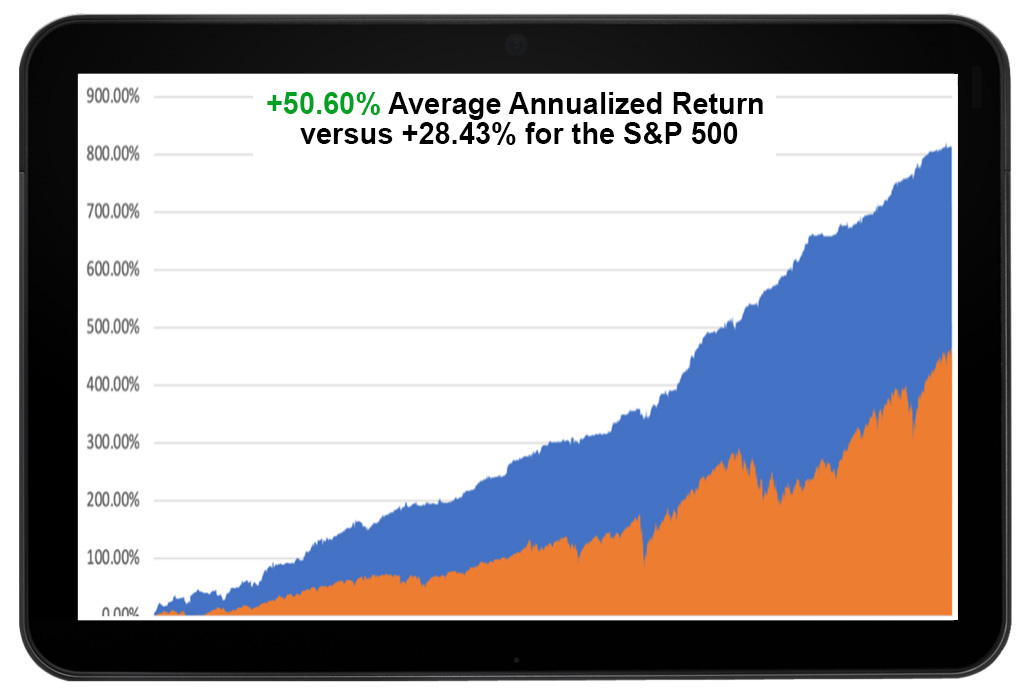

Your Source For Winning Trade Alerts, Real Market Wisdom, and Global Economic Insights!

Sign up for free! and get my free research today!

One of the most fascinating things I learned when I first joined the equity trading desk at Morgan Stanley during the early 1980s was how to parallel trade. A customer order would come in to buy a million shares of General Motors (GM), and what did the in-house proprietary trading book do immediately? It loaded

There is no doubt that the “underground” economy is growing. No, I’m not talking about violent crime, drug dealing, or prostitution. Those are all largely driven by demographics, which right now are at a low ebb. I’m referring to the portion of the economy that the government can’t see and therefore is not counted in

I am constantly barraged with emails from gold bugs who passionately argue that their beloved metal is trading at a tiny fraction of its true value and that the barbaric relic is really worth $5,000, $10,000, or even $50,000 an ounce (GLD). They claim the move in the yellow metal we are seeing is only

It’s official: Absolutely no one is confident in their long-term economic forecasts right now. I heard it from none other than the chairman of the Federal Reserve himself. The investment rule book has been run through the shredder. It has in fact been deleted. That explains a lot about how markets have been trading this

Learn from 24 of the best professionals in the market with decades of experience and the track records to prove it. They are offering a smorgasbord of successful trading strategies. Every strategy and asset class will be covered, including stocks, bonds, foreign exchange, precious metals, commodities, energy, and real estate. Get the tools to build

Below please find subscribers’ Q&A for the March 19 Mad Hedge Fund Trader Global Strategy Webinar, broadcast from Incline Village, NV. Q: I tried to get into ProShares Short S&P500 (SH), it seems pretty illiquid. How did you get in? A: Well, before I actually sent out the trade alert, I tested the liquidity of

The original purpose of this letter was to build a database of ideas to draw on in the management of my hedge fund. When a certain trade comes into play, I merely type in the symbol, name, currency, or commodity into the search box, and the entire fundamental argument in favor of that position pops

Demographics is destiny. If you ignore it as an investor, you will be constantly behind the curve wondering why your performance is so bad. Get ahead of it, and people will think you are a genius. I figured all this out when I was about 20. I realized then, back in 1972, that if I

Followers of the Mad Hedge Fund Trader alert service have the good fortune to own four in-the-money options positions that expire on Friday, March 21, and I just want to explain to the newbies how to best maximize their profits. These involve the: Risk On (NVDA) 3/$88-$90 call spread

I have been learning a new language over the past few weeks (I already speak six). And like learning any new language, it has been a bumpy road. I remember a family dinner I had in Tuscany in 1968. The dessert was chocolate cake. I didn’t know how to say “cake” in Italian, so I

Followers of the Mad Hedge Fund Trader alert service have the good fortune to own three in-the-money options positions that expires on Friday, February 21, and I just want to explain to the newbies how to best maximize their profits. This involves the: Current Capital at Risk Risk On (NVDA) 2/$90-$95 call spread

Take those predictions, forecasts, and prognostications with so many grains of salt. They have a notorious track record for being completely wrong, even when made by the leading experts in their fields. In preparing for my autumn lecture series, I came across the following nuggets and thought I’d share them with you. There are some

While trading one market is hard enough, two is almost more than one can bear. In fact, we have all been trading two markets since 2025 began. On the up days, it appears that the indexes are about to break out of a tediously narrow trading range. The market’s inability to go down is proof

When I first arrived on Wall Street during the early 1980s, some of the old veterans who worked through the 1929 stock market crash were just retiring and passed their stories on to me before they left. One was my old friend, Sir John Templeton, founder of the Templeton funds, who often hosted me for

While in New York waiting to board Cunard’s Queen Mary 2 to sail for Southampton, England, a few years ago, I decided to check out the Bay Ridge address near the Verrazano Bridge where my father grew up. I took a limo over to Brooklyn and knocked on the front door. I told the owner

I am one of those cheapskates who buy Christmas ornaments by the bucket load from Costco in January for ten cents on the dollar because my 11-month theoretical return on capital comes close to 1,000%. I also like buying flood insurance in the middle of the summer drought, when the forecast in California is for

With the Volatility Index back down to a bargain $16, I am getting deluged with emails from readers asking if it is time to start hedging portfolios one more time and buying the iPath S&P 500 VIX Short Term Futures ETN (VXX). The answer is not yet, but soon, possibly very soon. And here is

I have a new outlook for the US stock markets. The current government's economic policy reminds me a lot about the Marine Corps boot camp. Through harsh treatment and rigorous training, the Marines seek to destroy incoming recruits. They then spend 13 weeks rebuilding a new soldier from scratch who is obedient, respectful, follows orders,

I just received an excited text message from an excited Concierge client. His short position in the (TSLA) February 2025 $540-$550 vertical bear put debit spread had just been called away. That meant he would receive the maximum profit a full 11 trading days before the February 21 option expiration. With the heightened volatility this

There is a new social movement taking place which you probably haven’t heard about. Increasing numbers of people, especially Millennials, are engineering their personal finances to make early retirement possible. I’m not talking about hanging it up at 60, 55, or even 50. I’m talking extreme early retirement, like 45, 40, or even 30! I

tastytrade, Inc. (“tastytrade”) has entered into a Marketing Agreement with Mad Hedge Fund Trader (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade and/or any of its affiliated companies. Neither tastytrade nor any of its affiliated companies is responsible for the privacy practices of Marketing Agent or this website. tastytrade does not warrant the accuracy or content of the products or services offered by Marketing Agent or this website. Marketing Agent is independent and is not an affiliate of tastytrade.

Today is when you get off the fence and join!

To make this offer utterly irresistible I will throw in a free copy of my best-selling book, Stocks to Buy for the Coming Roaring Twenties. Read it now before the companies I recommended double in value again!

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.

This site uses cookies. By continuing to browse the site, you are agreeing to our use of cookies.

OKLearn moreWe may request cookies to be set on your device. We use cookies to let us know when you visit our websites, how you interact with us, to enrich your user experience, and to customize your relationship with our website.

Click on the different category headings to find out more. You can also change some of your preferences. Note that blocking some types of cookies may impact your experience on our websites and the services we are able to offer.

These cookies are strictly necessary to provide you with services available through our website and to use some of its features.

Because these cookies are strictly necessary to deliver the website, refuseing them will have impact how our site functions. You always can block or delete cookies by changing your browser settings and force blocking all cookies on this website. But this will always prompt you to accept/refuse cookies when revisiting our site.

We fully respect if you want to refuse cookies but to avoid asking you again and again kindly allow us to store a cookie for that. You are free to opt out any time or opt in for other cookies to get a better experience. If you refuse cookies we will remove all set cookies in our domain.

We provide you with a list of stored cookies on your computer in our domain so you can check what we stored. Due to security reasons we are not able to show or modify cookies from other domains. You can check these in your browser security settings.

These cookies collect information that is used either in aggregate form to help us understand how our website is being used or how effective our marketing campaigns are, or to help us customize our website and application for you in order to enhance your experience.

If you do not want that we track your visist to our site you can disable tracking in your browser here:

We also use different external services like Google Webfonts, Google Maps, and external Video providers. Since these providers may collect personal data like your IP address we allow you to block them here. Please be aware that this might heavily reduce the functionality and appearance of our site. Changes will take effect once you reload the page.

Google Webfont Settings:

Google Map Settings:

Vimeo and Youtube video embeds: